What is the UK Plastic Packaging Tax?

In 2018, the UK government announced the new UK Plastic Packaging Tax in their budget as a part of the government’s 25-year environmental plan, and 4 years later it finally came into play. As of April 1st, 2022, any company importing or manufacturing 10+ tonnes of plastic packaging components in the UK will be subject to this tax. And this time there’s no exceptions for large companies trying to avoid sustainability practices.

Companies using packaging with components containing 30% or more recycled plastic, may face exemptions from taxes but unfortunately for most companies, this isn’t the case.

At the end of the day, the tax is expected to have a positive impact on the environment by reducing the amount of plastic waste produced across supply chains, while creating a more circular economy.

How much does the UK Plastic Packaging Tax cost?

The UK Plastic Packaging Tax is far from cheap.

But unlike many other taxes, producers, suppliers, and importers of plastic packaging have the power to make substantial modifications in their supply chain that can reduce the impact of this new tax.

Tax Rates

The plastic packaging tax has a starting rate of £200 per metric tonne of plastic packaging. This means that businesses will have to pay for every tonne of plastic packaging produced or imported that contains less than 30% recycled plastic in their entire supply chain.

This considered businesses should evaluate strategies to minimize the financial impact of the tax on operations.

Because as companies will quickly see, the greater the amount of plastic packaging produced the more difficult it is to file and track these new taxes.

How much are companies willing to pay?

The cost companies are willing to pay to meet these new tax requirements is a question I, unfortunately, can’t answer. Each will have to do their own due diligence on the impact the new plastic packaging tax will have on their bottom line.

But it’s definitely a question all businesses should start asking all members of their teams – and of manufacturers of plastic packaging.

The unique thing about this tax is that companies have the power of reduction. Reducing plastic content and increasing recycled material in packaging will yield lower taxes and vice versa.

I know most companies don’t like to pay taxes and I’m going to make the assumption yours doesn’t either.

For the plastic packaging tax businesses that make the change to decrease virgin plastic will only reap the benefits for all stakeholders involved.

Comparison of Plastic Packaging Taxes in Other Countries

The UK Plastic Packaging Tax is part of a growing trend of countries around the world implementing taxes and fees on single-use plastics. And all these taxes have a common goal of reducing plastic waste and promoting sustainability – they are, in a sense, an environmental tax.

Many countries including France, Italy, and Ireland have introduced a similar plastic packaging tax. However, it is important to note that the details of these taxes vary widely, with some countries focusing on specific types of plastic packaging or different tax rates.

Although overall, while the specifications may vary, the overarching goal is shared among many countries.

For the UK, the plastic packaging tax is part of the UK government’s broader efforts to tackle plastic pollution, and its success will depend heavily on how effectively businesses respond.

How will the UK Plastic Packaging Tax be implemented?

In the UK, HM Revenue and Customs (HMRC), is responsible for ensuring that businesses comply with tax laws and regulations – and they’re no joke.

HMRC has the power to investigate and penalize businesses that fail to comply with tax requirements, including environmental taxes like the UK Plastic Packaging Tax.

Additionally, administrators of HMRC will oversee the implementation and enforcement of the tax to ensure that all businesses responsible for registering for the tax and carrying out their compliance checks are doing so.

How companies will report and pay tax

Businesses needing to pay the tax must be able to accurately track how much plastic they are producing, and for many companies, this is no easy task…

Especially for businesses that lack visibility into their supply chain.

The tax is calculated based on the weight of plastic packaging so companies must keep records of plastic packaging weights manufactured or imported. These records also allow companies to provide evidence of tax exemptions based on recycled content.

The plastic packaging tax is paid on a quarterly basis and companies are required to submit their tax returns to HMRC, which must include all the details of the amount of plastic packaging that is liable for the tax and the amount of tax that is payable.

If specifications or materials used to make plastic packaging change this information must also be accounted for and that is why it’s so important for companies to have visibility into their supply chains. Companies that aren’t keeping their accounts and records up to date will be the first to face the consequences.

HMRC will carry out compliance checks to enforce that taxpayers are keeping up to date with their accounts and records. And companies that fail to comply with the tax or submit inaccurate records may face penalties and fines.

Challenges of implementing the UK Plastic Packaging Tax

There are several key challenges facing companies who must comply with the tax…

For most companies the key issue is compliance. Businesses will need to accurately report the weight and recycled content of plastic packaging with details they haven’t previously needed.

Cost is also of concern, especially for smaller businesses that find incorporating recycled content much more expensive.

The complexity of the tax is likely to force companies to make difficult decisions as they overcome new challenges. And successful implementation will require collaboration, communication, and investment systems never seen before to ensure company compliance.

Impact of the UK Plastic Packaging Tax

With the UK Plastic Packaging tax newly implemented its impact is still not fully known although this new tax is expected to have several drastic changes on both the environment and business economics.

Environmental and public health benefits

One of the key aims of the plastic packaging tax is to encourage businesses to increase the amount of recycled plastic in their packaging which is recognized as a significant step towards reducing waste in the landfill.

And the environmental impacts go beyond just plastic reduction…

The plastic packaging tax is an important step in overall climate change reduction. Producing new plastic requires significant amounts of energy, resulting in excess carbon emissions. By promoting the use of recycled plastic, the plastic packaging tax will help reduce carbon emissions and support the UK’s goal of reaching net-zero emissions by 2050.

At the end of the day, we all know that plastic waste in the environment can have adverse effects on public health, including air and water pollution. The plastic packaging tax is just another step in the right direction to promote a cleaner environment for people in all industries.

Economic impact on companies

Environmental benefits aside, businesses have expressed concerns about the economic impact of the tax on their operations.

Some businesses have argued that the tax will increase their costs and reduce their competitiveness against international companies that do not have to pay such taxes.

But the UK government believes that incentivizing businesses to use more recycled content in their packaging or switching to alternatives, to reduce taxes, could lead to a reduction in plastic waste and eventually contribute to a circular economy.

The tax will encourage businesses to find more cost-effective ways to use recycled materials in their packaging and might be a key driver of innovation in the world of packaging.

Economic impact on consumers

With increased costs of packaging products for companies, consumers may start to see higher prices on their favorite items.

This is likely to occur in industries such as food and beverage, along with beauty and cosmetics, where plastic packaging is commonly used.

Implications of wider sustainability adoption and corporate responsibility

Companies looking to make true changes related to sustainability should not stop at tax compliance.

With the topic of sustainability here to stay, the UK plastic tax encourages businesses to use more recycled materials not just to reduce taxes but to drive change through all business practices.

This tax can drive wider sustainability adoption and corporate responsibility by incentivizing companies to use more sustainable materials, encouraging innovation in sustainable packaging, and raising awareness of the impact of plastic waste.

And that’s what makes the UK Plastic PAckaging Tax more than just a tax…

Challenges of the UK Plastic Packaging Tax

Whether you are a consumer, supplier, or producer the UK Plastic Packaging Tax is likely to affect you in some way.

Businesses are likely to face difficult decisions related to increasing the prices of goods to offset tax payments or relocation operations to countries with less stringent regulations – and all these difficult decisions pose unique challenges.

It is up to companies to come up with innovative ways to face these challenges head-on because the issues of sustainability and climate change are not going away.

Criticisms of the UK Plastic Packaging Tax

Criticisms from industry and environmental organizations

The UK plastic packaging tax has received criticism from both industry and environmental organizations.

Some industry groups argue that the tax will increase costs for businesses and consumers, potentially leading to job losses or economic damage.

Other concerns are that the tax may not adequately take into account the challenges that businesses face in sourcing enough recycled plastic to meet the 30% threshold.

On the other hand, some environmental organizations have criticized the tax for not going far enough in reducing plastic waste and argue that the 30% threshold is too low to incentivize greater use of recycled plastic.

All this being said, there are many different views and perspectives on the effectiveness of the UK plastic packaging tax which are all valuable to consider, one not being more important than the other.

What this means for all industry professionals

Despite a company’s industry, they are likely to be affected by this new tax in some way, shape, or form; so it’s businesses’ obligation to start asking where in their supply chain they can make changes to reduce the burdens of this new tax.

Industry professionals will need to invest in new practices and processes to track and reduce levels of plastic waste.

This may require companies to reconsider who they are working with and may require the development of new partnerships and collaborations to ensure a reliable supply of recycled plastic.

To avoid potential penalties and ensure that products comply with tax requirements companies are going to need DNA-level data at all stages of production.

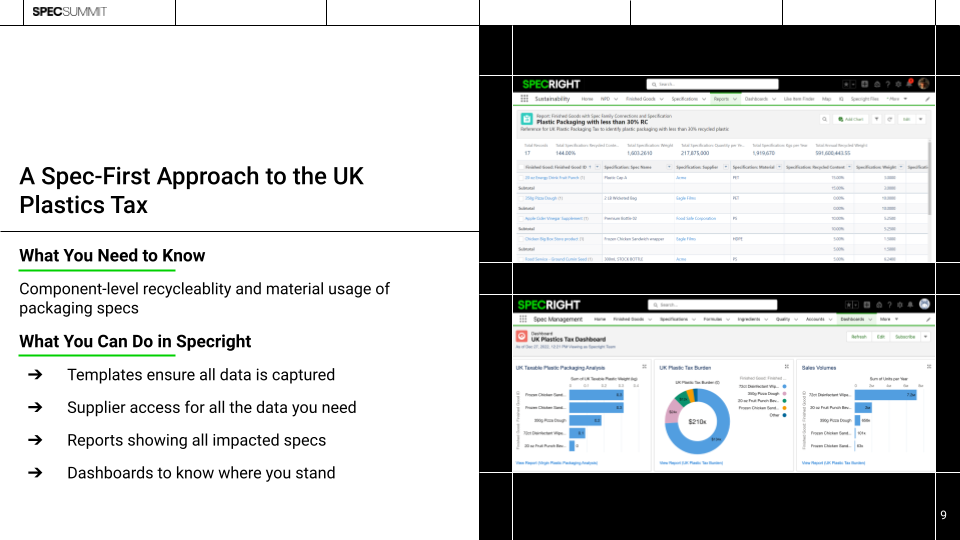

Companies taking a spec-first approach to data management will find making changes to meet tax compliances easy.

With Specright companies will have visibility into their supply chain and can see the main packaging culprits igniting expensive taxes.

Overall, the UK plastic packaging tax will require significant changes in the way businesses operate but companies willing to see these challenges as opportunities will benefit across the board.

To learn more about the UK Plastic Packaging Tax check out GOV.UK, and to read about how Specright can help you face the UK Plastic Packaging Tax head-on, request a demo.

Explore More Blogs

Get Started

With Specright’s Solution Suite, you can digitize, centralize, and link your specification data to drive efficiencies, intelligence, traceability, and collaboration within your organization and across your supply chain network.